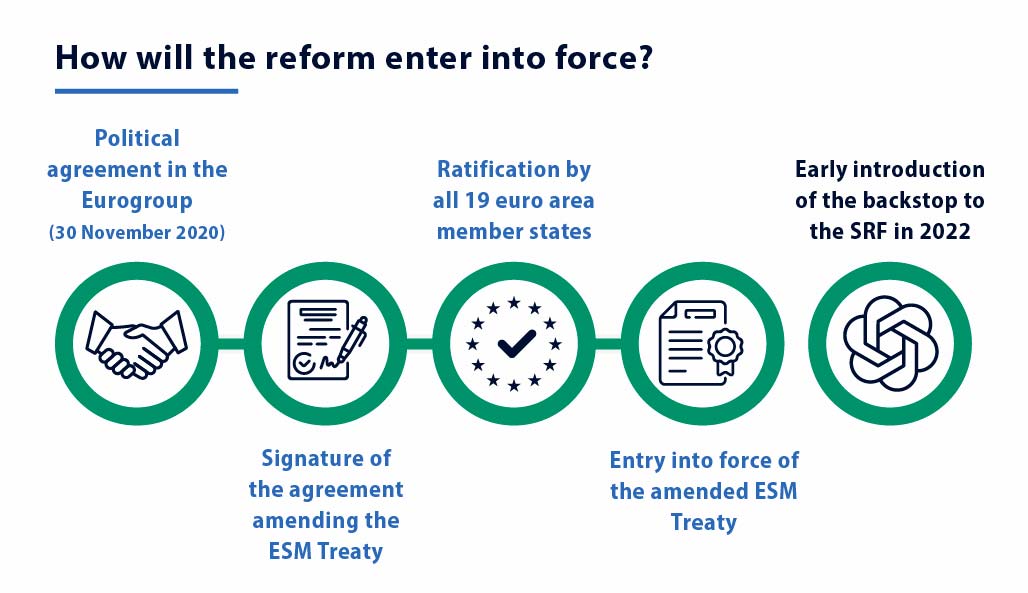

On 30 November 2020, the Eurogroup agreed to proceed with the reform of the European Stability Mechanism – ESM. The reform entails a number of new tasks for the ESM, which were agreed by the euro area finance ministers in their report to the Euro Summit in December 2018. This includes the further development of ESM instruments, enhancing the ESM’s role and setting up a common backstop for the Single Resolution Fund (SRF).

Enhancing the role of the European Stability Mechanism – ESM will further strengthen the crisis prevention and resolution capabilities of the euro area and its resilience. The extended mandate will come into force when the revised ESM Treaty is ratified by all 19 ESM Members. The ratification process will start when the Amending Agreement to the ESM Treaty is signed by ESM Members in January 2021.

European Stability Mechanism (ESM)

The European Stability Mechanism (ESM) was set up in 2012 by means of an intergovernmental treaty, outside the EU’s legal framework. Its core function is to grant conditional financial assistance to member countries that, despite having sustainable public debts, are experiencing temporary difficulties in raising funds on the market.

The conditionality varies according to the type of instrument used: for loans, it is in the form of a macroeconomic adjustment programme, described in a specific memorandum of understanding (MoU); it is less stringent for precautionary credit lines, intended for countries with fundamentally sound economic and financial conditions that are hit by adverse shocks.

ESM administration

The European Stability Mechanism – ESM is governed by a Board of Governors (the Board), composed of the 19 euro-area finance ministers. All major decisions are taken unanimously by the Board (including those on granting financial assistance and on MoUs with countries receiving such assistance). The ESM can act on decisions taken with a qualified majority of 85 per cent of votes if, in the event of a threat to the euro area’s economic and financial stability, the European Commission and the ECB request urgent decisions to be taken regarding financial assistance.

The ESM’s subscribed capital is €704.8 billion, of which €80.5 billion has been paid in: its lending capacity amounts to €500 billion. Italy’s subscribed capital in the ESM amounts to €125.3 billion and its paid-in capital is more than €14 billion. The voting rights of Board members are proportional to the capital subscribed by their respective countries. Germany, France and Italy have voting rights that exceed 15 per cent each and they may therefore veto urgent decisions.

ESM Treaty

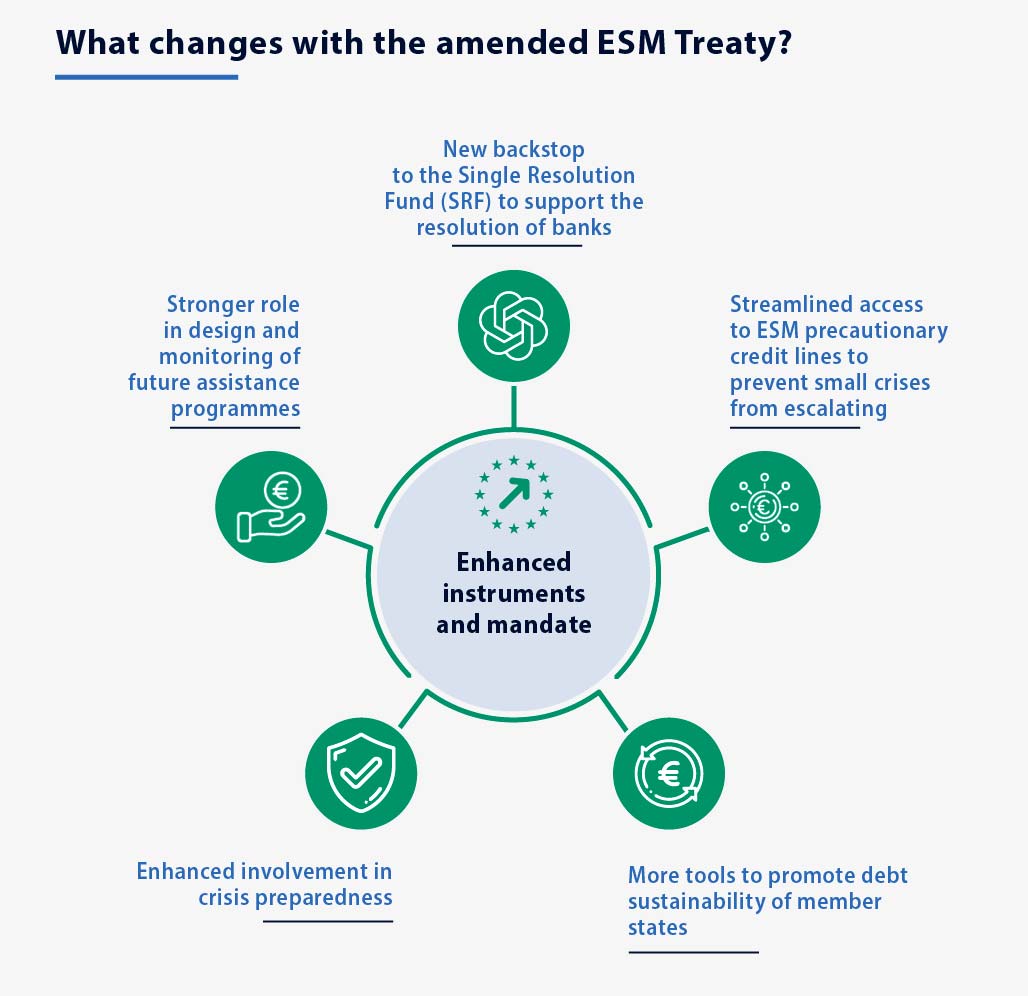

The proposed reform of the Treaty establishing the ESM addresses the prerequisites for granting financial assistance and the tasks to be carried out by the European Stability Mechanism – ESM. Overall, the changes proposed are limited in scope; the reform makes no provision for, nor does it envisage, any sovereign debt restructuring mechanism, and it does not entrust the ESM with any macroeconomic surveillance tasks.

The reform would also give the ESM a new function as a backstop to the Single Resolution Fund (SRF) within the bank crisis management framework.

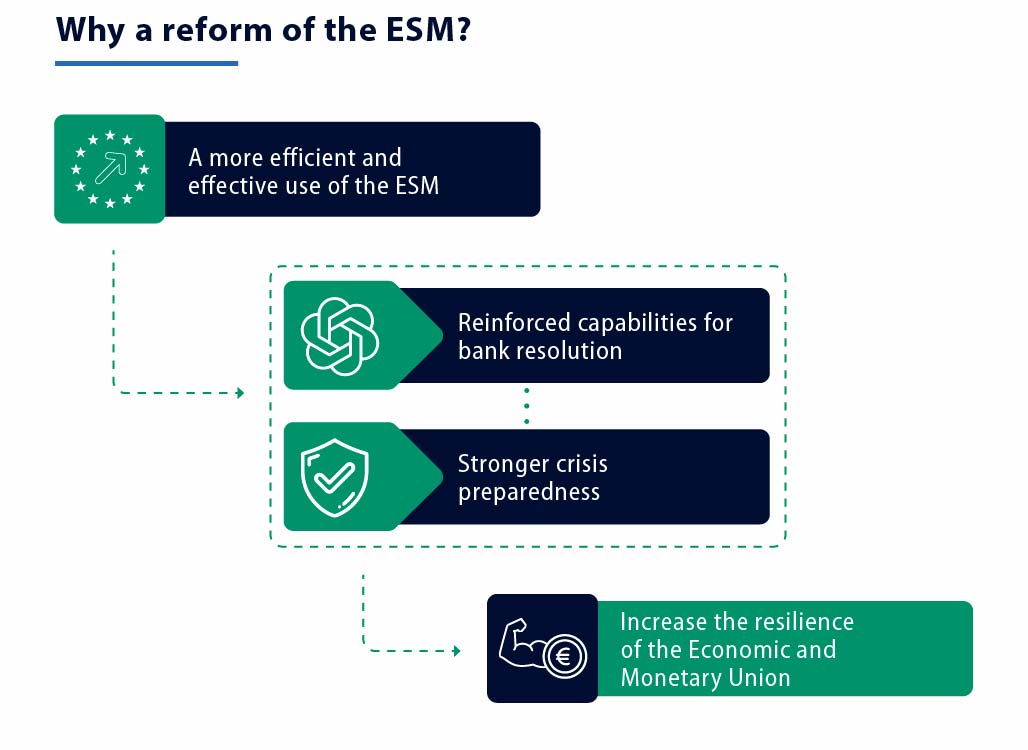

Why was the ESM Treaty revised?

The ESM Treaty was revised to provide a legal basis for a set of new tasks assigned to the ESM. These tasks were part of a wider package of measures approved the by Heads of State or Government in December 2018 to complete the Banking Union and to strengthen further the Economic and Monetary Union (EMU) and the ESM. This included the introduction of the common backstop for the Single Resolution Fund (SRF), to be provided by the ESM on behalf of the euro area, as well as the further development of the financial assistance instruments and the role of the ESM.

The signature of the revised Treaty early next year will pave the way for the ratification process of the revised Treaty in the 19 ESM Member States.

Will the ESM reform change anything in relation to the Pandemic Crisis Support (PCS)?

No, the conditions of the PCS will not change. The changes to the treaty do not impact the PCS instrument.

What is the common backstop?

The Single Resolution Fund (SRF) is a fund established by the EU for resolving failing banks in the context of the Banking Union. It is financed by contributions from the banking sector, not by taxpayer money. In the event that the SRF is depleted, the European Stability Mechanism – ESM can act as a backstop and lend the necessary funds to the SRF to finance a resolution. To this end, the ESM will provide a revolving credit line.

If non-euro area Member States join the Banking Union, the ESM and non-euro area Member States will together provide the common backstop to the SRF, through parallel credit lines.

How much could the ESM lend to the Single Resolution Fund?

The nominal cap for ESM loans to the SRF is set at €68 billion. This figure is expected to be above the target level of the SRF (1% of covered deposits in the banking union) when the ESM backstop is introduced in 2022. If the credit line is used, the SRF will pay back the ESM loan with money from bank contributions within three years, although this period can be extended so that the total maturity is up to five years. As a result, it will be fiscally neutral over the medium term.

What can be the ESM’s role as a potential facilitator?

In the future the European Stability Mechanism – ESM may, if so requested by the relevant ESM Member, facilitate the dialogue between that ESM Member and its private investors on a voluntary, informal, non-binding, temporary, and confidential basis. The constant contact the ESM already has with key players in the euro area sovereign debt markets makes the ESM well placed for this role.

How will the PCCL work under the revised ESM Treaty?

Access to a PCCL will be based on eligibility criteria and limited to European Stability Mechanism – ESM Members where the economic and financial situation is fundamentally strong. As a rule, ESM Members need to meet quantitative benchmarks and comply with qualitative conditions related to EU surveillance. The eligibility criteria include a track record of two years preceding the request for a PCCL with a general government deficit not exceeding 3% of GDP, a general government structural budget balance at or above the country specific minimum benchmark, a debt/GDP ratio below 60% or a reduction in the differential with respect to 60% over the previous two years at an average rate of 1/20 per year. In addition, the requesting country should have access to international capital markets on reasonable terms and a sustainable external position. It should also not be experiencing excessive imbalances or severe financial sector vulnerabilities.

In the case of PCCL, there will be no need for the requesting country to sign a Memorandum of Understanding (MoU). Instead, the country will specify its policy intentions in a Letter of Intent (LoI), committing to continuous compliance with the eligibility criteria. Continuous respect of the eligibility criteria will be assessed at least every six months. The ESM Member has the right to request funds at any time during the availability period according to the agreed terms.

What happens if a country does not comply with the PCCL eligibility criteria?

If an ESM Member no longer complies with the eligibility criteria for the PCCL, access to the credit line will be discontinued, unless the Board of Directors decides by mutual agreement to maintain the credit line. If the country has drawn funds before the non-compliance is established, an additional margin will be charged.

What are the requirements for requesting an ECCL?

Access to an Enhanced Conditions Credit Line (ECCL) is open to ESM Members that do not comply with some of the eligibility criteria required for accessing a Precautionary Conditioned Credit Line (PCCL) but whose general economic and financial situation remains sound. The requesting country has to sign a Memorandum of Understanding (MoU) detailing policy conditionality, aimed at addressing the remaining weaknesses, and requiring a continuous respect of the eligibility criteria which were considered met when the credit line was granted. Compliance with conditionality will be assessed on the basis of quarterly compliance reports submitted to the ESM Board of Directors. The ESM Member has the right to request funds at any time during the availability period according to the agreed terms.

What changes regarding debt sustainability are made in the revised ESM Treaty?

The ESM Treaty has since the ESM’s inception in 2012 included the requirement that the ESM should only provide stability support to countries whose debt is considered sustainable. The revised ESM Treaty will also require the confirmation of a country’s repayment capacity. The assessments on debt sustainability and repayment capacity will be conducted by the European Commission, in liaison with the ECB, and the European Stability Mechanism – ESM, on a transparent and predictable basis, while allowing at the same time a sufficient margin of judgement.

No changes are made regarding private sector involvement. The current ESM Treaty already addresses the point of an adequate and proportionate private sector involvement in accordance with long established IMF practice only in exceptional cases. Neither the current ESM Treaty, nor the revised Treaty make debt restructuring automatic.

What can be the ESM’s role as a potential facilitator?

In the future the European Stability Mechanism – ESM may, if so requested by the relevant ESM Member, facilitate the dialogue between that ESM Member and its private investors on a voluntary, informal, non-binding, temporary, and confidential basis. The constant contact the ESM already has with key players in the euro area sovereign debt markets makes the ESM well placed for this role.

What will be the ESM’s new tasks in future financial assistance programmes?

The ESM will have a stronger role in the design, negotiation and monitoring of conditionality in future financial assistance programmes.

When an ESM Member requests support, the Commission in liaison with the ECB, and the ESM will work closely together to prepare the assessments supporting the decision to grant a loan. These include the assessment of a Member’s debt sustainability and repayment capacity, the assessment of financial stability risks, and the financing needs of the Member requesting support. European Stability Mechanism will perform its analysis and assessment from the perspective of a lender.

The European Stability Mechanism – ESM will be involved in the design of policy conditionality and any future Memorandum of Understanding (MoU) detailing the conditionality attached to the financial assistance facility will be signed by both the Commission and the ESM Managing Director.

The European Stability Mechanism – ESM will also monitor compliance with the conditionality attached to the financial assistance facility together with the Commission in liaison with the ECB.

How will the ESM/EC perform the debt sustainability and the repayment capacity assessments?

The assessment of debt sustainability and repayment capacity, for the member state requesting financial assistance, will be carried out on a transparent and predictable basis. Assessments for financial assistance programmes will be carried out by the Commission in liaison with the ECB, and the ESM.

For the preparation of the debt sustainability analysis (“DSA”), the Commission will work on the basis of its growth forecasts and estimates, existing stocks and stock-flow adjustments, net borrowings and fiscal path, incorporating also the Commission’s assessment of compliance with Stability and Growth Pact requirements. The ESM will contribute to the DSA with the analysis of the Member’s financing plans and cost of funding, which entails the assessment of the liquidity position, sovereign bond market and potential risks stemming from the size and structure of outstanding debt, debt issuance plans, interest rate developments, refinancing capacity and market access.

The repayment capacity assessment builds upon and complements the debt sustainability analysis and shifts the focus to the beneficiary Member State’s ability to manage its overall payment obligations, or liabilities, in a way ensuring the repayment to the ESM over the entire horizon of the lending relationship.

The general expectation is that institutions will come to a common view and present the debt sustainability and the repayment capacity assessments to the ESM decision-making bodies. In case the collaboration does not yield a common view, the Commission makes the overall assessment of the sustainability of the public debt, while the ESM assesses the capacity of the Member concerned to repay ESM loans.

Will the ESM analyse countries after they have concluded their stability support programmes?

As until now, the ESM will participate in post-programme monitoring to safeguard its balance sheet by assessing the ability of a beneficiary Member to repay. In accordance with the Early Warning System (“EWS”) Procedure established pursuant to Article 13 (6) of the ESM Treaty, the EWS starts with the first disbursement and continues until all financial assistance is fully repaid.

In principle, post-programme surveillance missions by the Commission and EWS missions are combined, to prevent unnecessary duplication of analysis by the Commission and the ESM and to avoid unnecessary burden on the relevant Member.

Will the ESM analyse countries in non-crisis times?

The Commission and the ESM will meet informally to share assessments and analysis pertaining to their respective competences as well as to discuss and assess macro-financial risks. The Commission, in agreement with the Member State concerned, may also invite ESM staff to join its missions related to economic policy coordination and budgetary monitoring.

The Members of the Commission responsible for Financial Stability and Economic and Financial Affairs and the ESM Managing Director meet at least twice a year, also in non-crisis times, to discuss issues of common interest, including the main findings of the macro-financial risk analysis.

What are the next steps in implementing the ESM reform?

The revised ESM Treaty will come into force once it has been ratified by all 19 ESM Member States. This involves approval in parliaments in all Member States. The ratification process will start following the signature of the Amending Agreement to the ESM Treaty in January 2021.

What are the next steps in the EMU reform?

The ESM reform is part of a comprehensive package of measures to deepen Economic and Monetary Union (EMU), including work on completing Banking Union. Capital Market Union serves to strengthen the single market for the European Union. It is particularly important for the euro area as it strengthens financing for the economy and makes it more robust.

Discussions will continue on the creation of a European deposit insurance scheme, which is the missing third pillar of banking union. More technical work will be needed to define the possible ways forward.

The Bank of Italy, the central bank of the Republic of Italy has published a very interesting Q & A article on the web concerning ESM treaty reform.

1. Is it true that the ESM is of no use to Italy and in fact actually damages it?

The ESM is not an organization of no use to Italy and it certainly does not damage the country; it helps Italy just as much it helps every other euro-area country.

The ESM mitigates the contagion risks linked to possible crises in a euro-area country, risks that have materialized in the past with serious repercussions for Italy (as happened starting in 2010 with the Greek crisis, for example). The presence of the ESM reduces the probability of a sovereign default, at least for countries experiencing temporary difficulties that can be resolved with loans or credit lines (for the other countries nothing changes).

The reform, which allows the ESM to act as a backstop to the Single Resolution Fund, means the ESM would also help to limit the contagion risks linked with systemically important banking crises.

With specific reference to Italy, refinancing the country’s high public debt could take place in a more orderly fashion and with lower costs if financial market conditions remain relaxed.

2. Is it true that Governor Visco defined the reform as a ‘huge risk’?

No, the Governor argued that introducing a Debt Restructuring Mechanism would involve a ‘huge risk’; the reform of the ESM neither provides for nor envisages this kind of mechanism.

3. Is it true that the reform of the ESM would mean an automatic restructuring of debt in the event that Italy requested access to its funds?

The reform neither provides for, nor does it envisage in the future, an automatic sovereign debt restructuring mechanism. As in the current Treaty, financial assistance is not given in exchange for debt restructuring. The text of the reform clarifies that the preliminary checks on the debt sustainability of the country requesting assistance are in no way automatic (they are carried out ‘allowing for a sufficient margin of judgment’) and reiterates that private sector involvement in debt restructuring must remain limited to exceptional circumstances.

4. Is it true that the reform is designed to facilitate access to funds for countries with their public finances in order (for example Germany, in order to deal with a banking crisis) and to make access to funds more difficult for countries that do not comply with the Maastricht criteria (for example Italy, in the event of a sovereign debt crisis)?

The preconditions for accessing ESM funds (loans and precautionary credit lines) will remain essentially unchanged following the reform.

As regards loans (which are contingent on a macroeconomic adjustment programme), the preliminary check on debt sustainability (already provided for in the current treaty) would be accompanied by another check on a country’s capacity to repay the loan (already part of the post-programme surveillance). These clauses are there to protect the ESM’s resources, to which Italy is the third largest contributor.

As far as precautionary credit lines are concerned, the reform confirms the difference already set out in the current Treaty between ‘simple’ credit lines (Precautionary Conditioned Credit Line – PCCL) and those ‘with an enhanced conditionality’ (Enhanced Conditions Credit Line – ECCL). PCCLs are for countries meeting the requirements of the Stability and Growth Pact that do not have excessive macroeconomic imbalances or financial stability problems, while ECCLs are for countries that do not fully meet the above prerequisites and are therefore asked to take corrective measures.

The reform refines the criteria currently in force for accessing PCCLs and makes them more stringent. Specifically, the reform establishes that PCCLs can normally only be used by countries not subject to a procedure for excessive deficit or excessive macroeconomic imbalances, and envisages quantitative benchmarks for public finance variables. Given the more stringent requirements, signing a Memorandum of Understanding would no longer be required for the granting of a PCCL; this credit line would be granted upon receipt of a letter of intent from the requesting country.

5. Is it true that the reform of the ESM increases the probability of a sovereign default?

No, that is not true. The reform reiterates that private sector involvement (PSI) in sovereign debt restructuring must remain strictly limited to exceptional circumstances. It is in light of PSI being confirmed as an exceptional case that we should interpret the amendment to the collective action clauses (CACs), which will come into force from 2022.

According to this amendment, if a country decided to proceed with debt restructuring, a single vote by government security holders would be sufficient to amend the terms and conditions of all the bonds (‘single limb’ CACs), instead of dual votes (one for each issuance and one for the bonds as a whole). The purpose of this amendment is to make any debt restructuring more orderly, thereby reducing the costs linked to the uncertainty over how it will be done and how long it will take, which damage both the debtor country and its creditors. Yet these costs are only a small part of the overall costs of a default, and reducing them is certainly not enough to make a default more likely: the disastrous social and economic consequences of a default are the real deterrent.

As already happened following the introduction of the current CACs in 2013, this amendment, which does not increase the likelihood of a default but reduces the uncertainty surrounding its outcome, could lead to a fall in the sovereign debt risk premiums that burden the government bonds of all euro-area countries, including in Italy.

In any case, it should be remembered that the probability of a default depends above all on a country’s economic policies.

6. Is it true that, as regards the decision-making process for the ESM to grant assistance to countries, the reform increases the power of the body governing the ESM (a technical body) rather than that of the European Commission (a political body)?

Although it carries out ‘technical’ tasks, the ESM is managed by a Board of Governors, composed of the 19 euro-area finance ministers who are responsible for deciding (usually unanimously) whether to grant financial assistance to countries that request funds.

The reform does not increase the ESM’s powers, but does envisage it playing an active role in crisis management and in the process for disbursing financial assistance, as well as in the subsequent surveillance; accordingly, it indicates the tasks of the ESM’s Managing Director.

The ESM will flank the European Commission, not replace it. How the two institutions cooperate will be set out in an agreement to be signed when the amendments to the Treaty come into force. The terms of the provisional agreement reached between the two institutions in 2018 are echoed in the text of the reform proposal.

The ESM’s activity is bound by compliance with EU legislation; the Commission is entrusted with checking this.

The overall assessment of the economic situation of countries and their position vis-à-vis the rules of the Stability and Growth Pact and of the Macroeconomic Imbalance Procedure remains the exclusive responsibility of the Commission.

The ESM should not serve the purpose of coordinating economic policies among the Member States for which European Union law provides the necessary arrangements.

7. Is it true that this reform means that Italy will have to pay additional funds into the ESM?

No, the ESM’s capital will remain unchanged, as will the rules that govern any future pay-ins.

8. Is it true that if the Mechanism has to intervene in a crisis, Italy will have to pay the missing share in within seven days?

The current Treaty already says that the paying in of further capital within seven days is only envisaged in conditions of absolute emergency, i.e. in the event that the ESM might risk finding itself in default towards its creditors.

Generally speaking, the decision to request further payments of capital rests with the Board of Governors and follows the normal voting procedures. However, the ESM’s Board of Directors can decide by a simple majority on payments to cover any losses that have reduced the level of paid-in capital. The reform does not affect these aspects.

9. Is it true that with this reform, neither the ECB nor the European Commission will be able to intervene in a crisis without a decision from the ESM?

The reform makes no changes in this regard.

The presence of ESM financial assistance (in the form of a loan accompanied by a macroeconomic adjustment programme or an ECCL) has always been a necessary condition for the ECB to intervene in the secondary market for a country’s government securities (using Outright Monetary Transactions – OMTs).

As regards the European Commission, the instrument at its disposal was and is the European Financial Stabilisation Mechanism (EFSM), which was set up in 2010 with a lending capacity of €60 billion and used to provide assistance to Ireland and Portugal. Now that the ESM is fully operational, the EFSM is only used for specific tasks, such as extending maturities on outstanding loans and granting bridge loans.