Every economic crisis is destined to be moderated by the Central Banks making a policy support mix. Christine Lagarde ECB President send a message that made the markets sick like have been tested positive for the “Coronavirus”.

I would hope that I would never have to do whatever it takes!

Christine Lagarde, ECB President

ECB Governing Council Press Conference

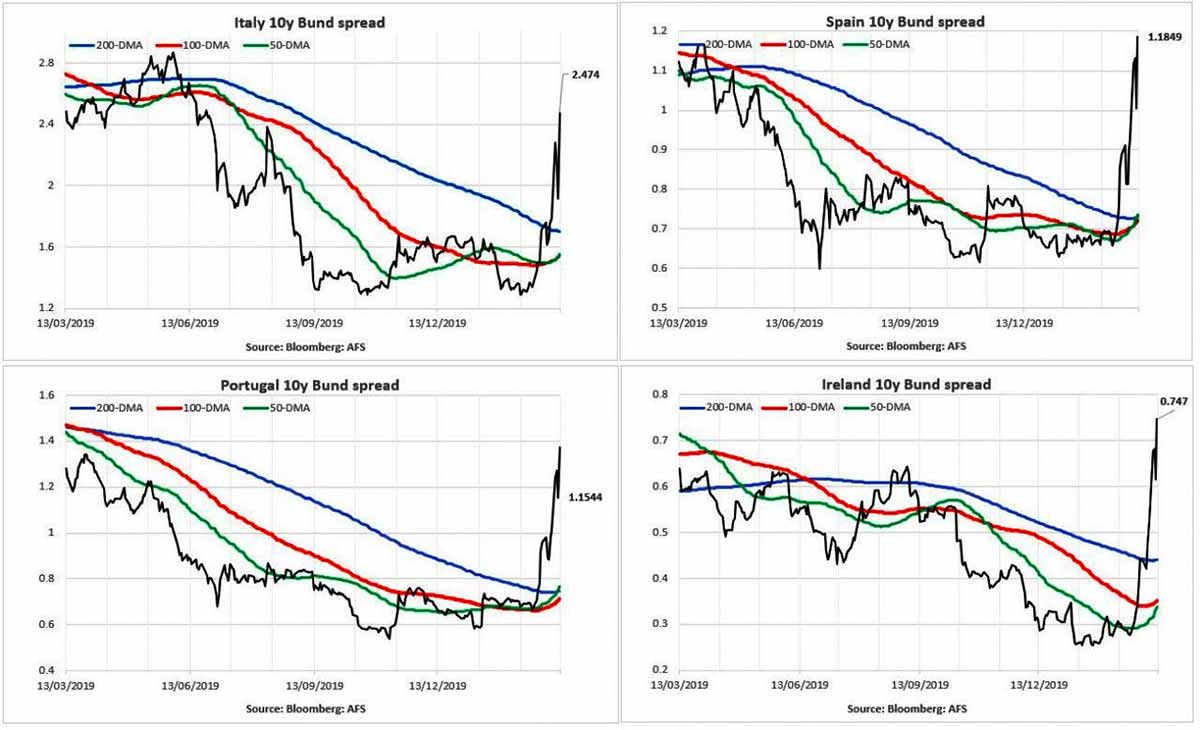

On Thursday, the spreads of Eurozone Member States like Spain, Portugal, Greece and Ireland sold off dramatically. Markets were concerned about the impact that a recession might have on the eurozone, but the final trigger was the confirmation that ECB wouldn’t provide extra help or support to these countries.

The European Central Bank (ECB) announced a number of measures to ensure that its directly supervised banks can continue to fulfil their role in funding the real economy as the economic effects of the coronavirus (COVID-19) become apparent.

Lagarde: We are not here to close spreads, there are other tools and other actors to deal with these issues

— European Central Bank (@ecb) March 12, 2020

ECB Banking Supervision provides temporary capital and operational relief in reaction to coronavirus

- Banks can fully use capital and liquidity buffers, including Pillar 2 Guidance

- Banks will benefit from relief in the composition of capital for Pillar 2 Requirements

- ECB to consider operational flexibility in the implementation of bank-specific supervisory measures

We are all facing something which is different from the Great Financial Crisis at this point in time! Christine Lagarde

The economies of the euro area are facing a major shock! EU outbreak sparks major fears as ECB predicts ‘major shock’. Christine Lagarde, vowed to use “all available tools” to fight economic infections as the Coronavirus continues to spread. The ECB announced an €120 billion increase in its quantitive easing programme to buy more bonds by the end of the year. This comes on top of its existing commitment to by €20 billion a month and a new pledge to offer banks cheaper loans so they can lend to small businesses.

NO cut to interest rates

ECB’s latest package of measures refuses to cut interest rates. “The interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00 percent, 0.25 percent and -0.5 percent respectively,” ECB declared.

Capital and liquidity buffers have been designed with a view to allowing banks to withstand stressed situations like the current one. The European banking sector has built up a significant amount of these buffers. The ECB will allow banks to operate temporarily below the level of capital defined by the Pillar 2 Guidance (P2G), the capital conservation buffer (CCB) and the liquidity coverage ratio (LCR). The ECB considers that these temporary measures will be enhanced by the appropriate relaxation of the countercyclical capital buffer (CCyB) by the national macroprudential authorities.

Can the above measures provide significant capital relief to banks in support of the economy?

Banks are expected to use the positive effects coming from these measures to support the economy and not to increase dividend distributions or variable remuneration. But on the other hand Banks need to have own funds in sufficient quantity and quality on the liabilities side of their balance sheet to be able to absorb losses.

Lagarde: It takes time for markets to analyse, dissect and appreciate what we do

— European Central Bank (@ecb) March 12, 2020

ECB Press Conference had a great impact and a sharp tumble in value of European stocks by as much as 10 percent, one of the worse days for decades.