Several EU Member States have a lengthy tradition of ensuring a national minimum wage for those at the lower-paid end of the workforce. By contrast, a number of Member States, including Germany, Ireland, the United Kingdom and many of the countries that joined the EU in 2004 or later, have only recently introduced minimum wage legislation, while six of the EU-28 Member States had no national minimum wage as of 1 January 2019.

European Minimum Wage

The term ‘minimum wages’ refers to various legal restrictions of the lowest rate payable by employers to workers. Statutory minimum wages are regulated by formal laws or statutes. In recent years there has been a pattern of relatively low wage increases (wage moderation) in most European countries, and many groups representing workers have argued that purchasing power and overall standards of living have fallen. Some politicians, worker representatives, pressure groups and commentators promote the idea of a ‘European minimum wage’ or national minimum wages set in all EU Member States.

The level of statutory minimum wages greatly varies between EU countries. National minimum wage levels are not necessarily changed every year, nor does the adjustment always result in a minimum wage increase — for example, the level of minimum wages in Greece decreased in 2012 as part of the austerity measures introduced by the government. The National Collective Agreement was suspended in Greece that year and the national minimum wage is now fixed by government decision.

Which country has the highest minimum wage 2018?

- Luxembourg €1,998.59

- Netherlands €1,578.00

- Ireland €1,563.25

Nominal increases

Vs

Real increases

The change in the statutory minimum wage should be viewed in the context of changing price levels. While a nominal wage is the amount of money you earn, it really doesn’t tell you much about your purchasing power because nominal wages don’t take into account changes in price levels. Your real wage is your nominal wage adjusted for inflation.

Inflation

Overall, across the EU, the minimum wage is in real terms growing more slowly in the EU15 than in the new Member States (NMS), indicating convergence between the two groups over the medium term.

List of European countries by minimum wage

Minimum wage statistics, as published by Eurostat, refer to national minimum wages. The national minimum wage usually applies to all employees, or at least to a large majority of employees in a country. It is enforced by law, often after consultation with social partners, or directly by a national intersectoral agreement.

Minimum wages are generally presented as monthly wage rates for gross earnings, that is, before the deduction of income tax and social security contributions payable by the employee; these deductions vary from country to country. National minimum wages are published by Eurostat bi-annually. They reflect the situation on 1 January and 1 July of each year. As a consequence, modifications to minimum wages introduced between these two dates are only shown for the following bi-annual release of data.

Variations in national minimum wages

Minimum wages in the EU Member States ranged from EUR 286 to EUR 2 071 per month in January 2019

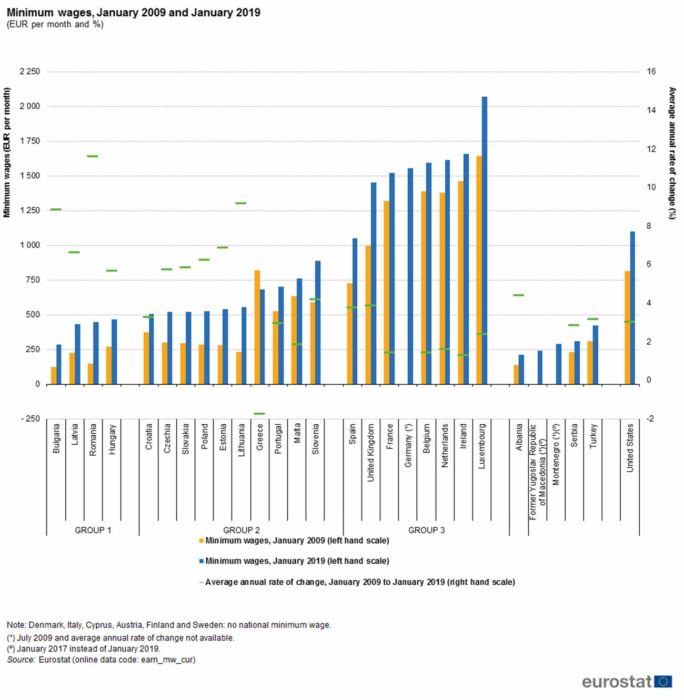

In January 2019, 22 out of the 28 EU Member States (Denmark, Italy, Cyprus, Austria, Finland and Sweden were the exceptions) had a national minimum wage, as did all of the EU candidate countries (Montenegro, the former Yugoslav Republic of Macedonia, Albania, Serbia and Turkey). As of 1 January 2019, monthly minimum wages varied widely across the Member States, from EUR 286 in Bulgaria to EUR 2 071 in Luxembourg.

Compared with January 2009, minimum wages (expressed in euro) were higher in January 2019 in every EU Member State having a national minimum wage, except in Greece where they were 16 % lower (cumulated over the 10 years, with average annual rate of change of -1.5 %). Between January 2009 and January 2019, the average annual rate of change of minimum wages was highest in Romania (11.6 %) and in Lithuania (9.1 %). In addition, Bulgaria (8.8 %), Estonia (6.9 %) and Latvia (6.6 %) as well as Poland (6.2 %) recorded significant increases.

Minimum wage levels in relation to median gross earnings

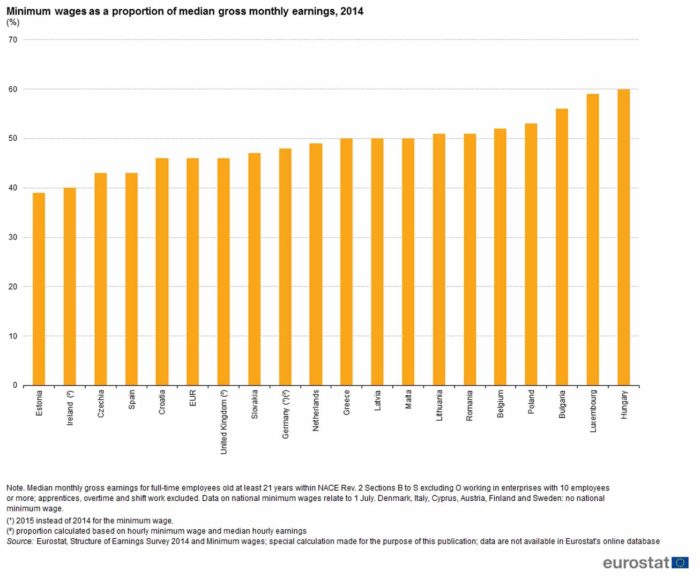

The following figure provides information in relation to the share of the national minimum wage in median gross earnings.

National minimum wages expressed in euro terms were taken as of 1 July 2014 and divided by the median gross earnings measured from the Structure of Earnings Survey (SES 2014). In July 2014, the proportion of minimum wages in median earnings across the EU Member States varied from 39 % to 64 %. For the purpose of this analysis, payments for overtime and shift work have been excluded from the calculation of median gross monthly earnings. In the case of Germany, France, Ireland and the United Kingdom, whose minimum wages are set on an hourly basis, the ratio was calculated as a proportion of the median hourly earnings. For the other 18 EU Member states, that have national monthly minimum wages, the ratio was calculated as a proportion of the median monthly earnings.

* Countries not covered by minimum wage statistics

As of 1 January 2019, there was no national minimum wage in Denmark, Italy, Cyprus, Austria, Finland and Sweden; this was also the case in the EFTA countries of Iceland, Norway and Switzerland. In Cyprus, minimum wages are set by the government for specific occupations. In Denmark, Italy, Austria, Finland and Sweden, as well as in Iceland, Norway and Switzerland, minimum wages are laid down by collective agreements for a range of specific sectors.

– Do we need a minimum salary in Europe?

The incidence of nominal and real wage rigidity!

Do we need a commom European Policy or decentralization allows the market to adjust wages?

When business conditions turn bad, collective agreements are associated with a lower degree of real wage rigidity.

Wage Inequality

Europe’s Ticking Time Bomb

With 20% of European workers making five times the income of the bottom 20% the slow growth of wages at the bottom has meant a manifold increase in inequality across Europe. Real Economy looks at how to solve a problem like inequality.

Can flexible pay components (Coupons, Bonus) be the solution needed?

Flexible benefits now is a portion of the salary that can be received against different expenses to primarily save on income tax.

– How could we estimate – count a European Minimum Wage – Salary?

– How does Flexible Benefits help employees?

– Can we count on Flexible Benefit Plans?

Should EU countries agree to a common European minimum wage?

EU Debates!

Your opinion counts!